4QFY2018 Result Update | Industrial Machinery

May 18, 2018

GMM Pfaudler Limited

Accumulate

CMP

`865

Performance Update

Target Price

`920

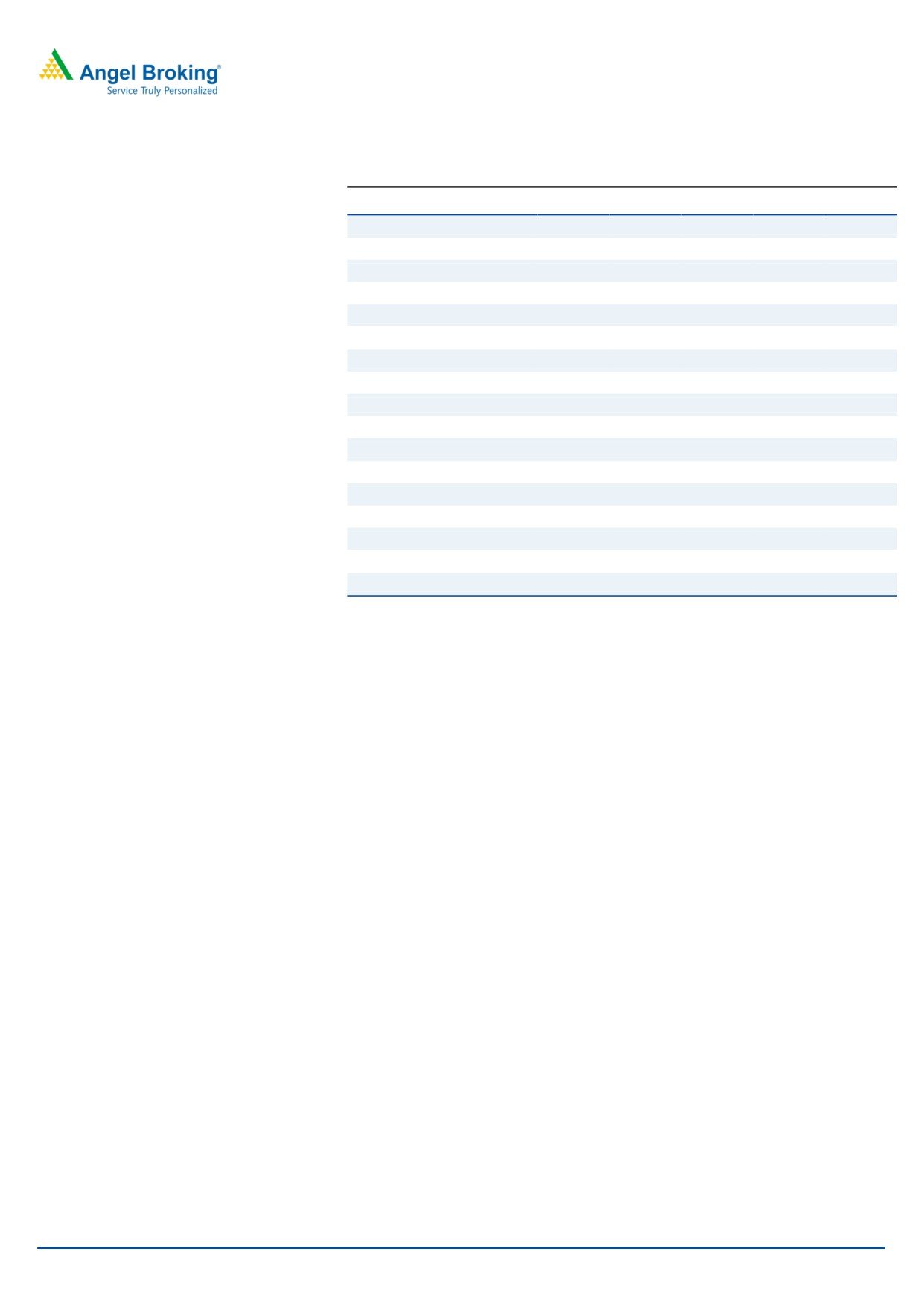

Standalone (` cr)

Q 4FY18

Q 4FY17

% yoy

Q 3FY18

% qoq

Investment Period

12 Months

Net sales

88

79

10.9

79

11

EBITDA

14

11

36.6

12

16.9

Stock Info

EBITDA margin (%)

16.4%

13.3%

308bps

15.5%

83.5bps

Sector

Industrial Machinery

A djusted PAT

Market Cap (` cr)

1,265

8.4

7.4

14.1

7.4

14

Beta

0.7

For Q4FY2018, GMM Pfaudler (GMM) posted a growth of 11%/14% yoy growth

52 Week High / Low

884/504

Avg. Daily Volume

5,837

in revenue/ PAT amid ~300 bps margin expansion. The company is seeing good

Face Value (`)

2

traction from its user industries like agrochemicals, which would drive 15-20%

BSE Sensex

33,597

revenue growth in next two years.

Nifty

10,682

Healthy order book: Q4’s top-line rose by 11% led by robust execution. Its

Reuters Code

GMMP.BO

subsidiary- MAVAG also did quite well with 7% yoy growth in FY2018 revenue. Its

Bloomberg Code

GMM.IN

FY2019 opening order backlog is much higher than that of FY2018. Pharma

Shareholding Pattern (%)

sector share has come down from historical 50% to 30% of revenue. Orders from

Promoters

75.0

Pharma City is likely to pick up in the next 6-9 months.

MF / Banks / Indian Fls

0.4

Margins were decent: Operating margin were robust at 16.4% due to better

FII / NRIs / OCBs

0.1

product mix and cost optimization. MAVAG has almost tripled its FY2018 profits

Indian Public / Others

24.5

to ` 14 cr owing to better absorption of fixed cost. MAVAG is likely to sustain

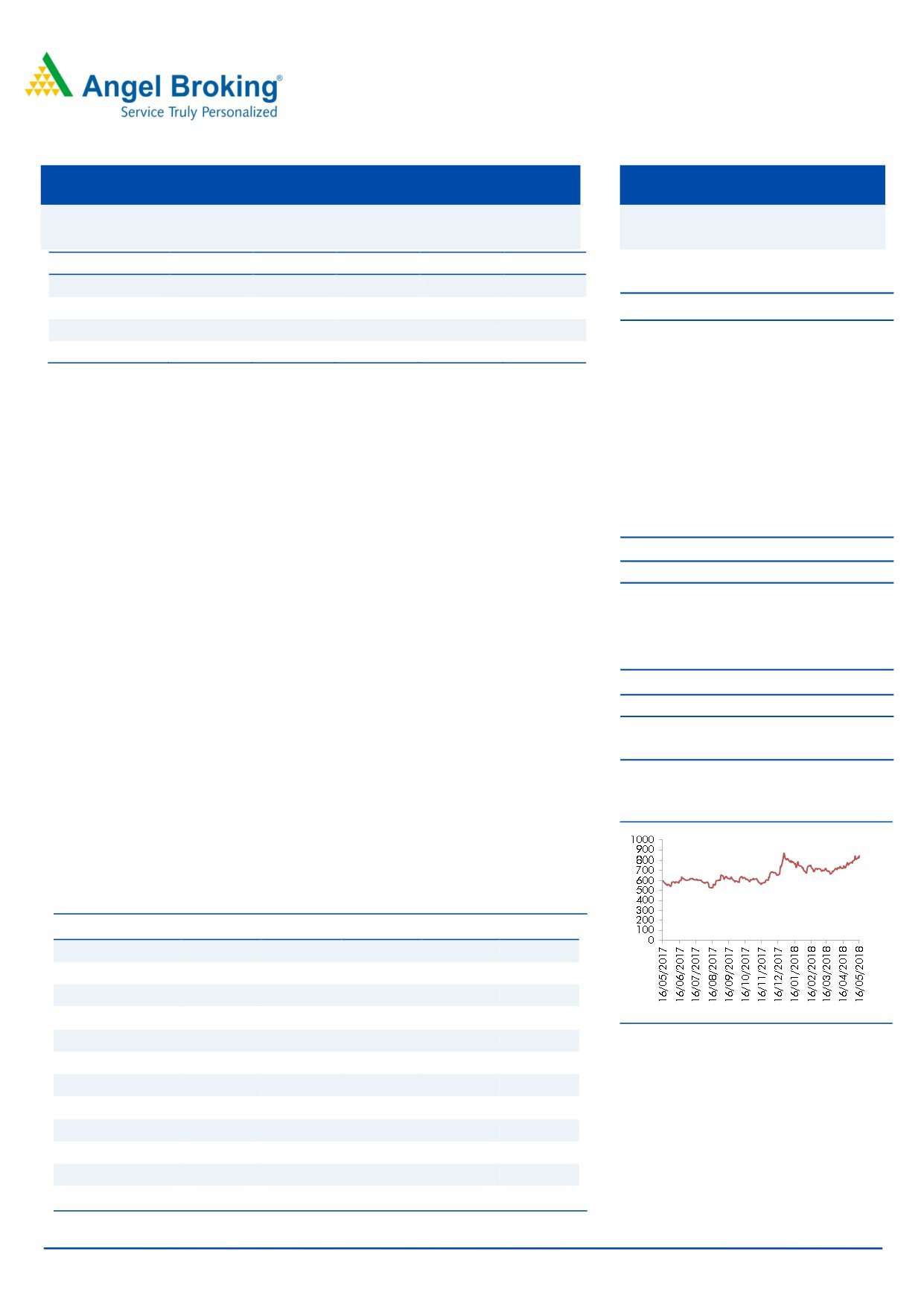

Abs.(%)

3m 1yr

3yr

operating margin at ~17% level.

BSE 200

1.9

11.7

32.8

Outlook and Valuation: We have fine tuned our earnings estimates in view of

GMM Pfaudler

18.6

65.0

225.0

FY2018 results. We are expecting a CAGR of ~18%/20% in revenue/ earnings

over FY18-20E. The stock has given 21% return since our initiation in April and is

3-year price chart

currently trading at 20x its FY2020 earnings which largely trails its earnings

growth trajectory. Hence, we recommend Accumulate with a target price of `920

(22x FY2020E EPS).

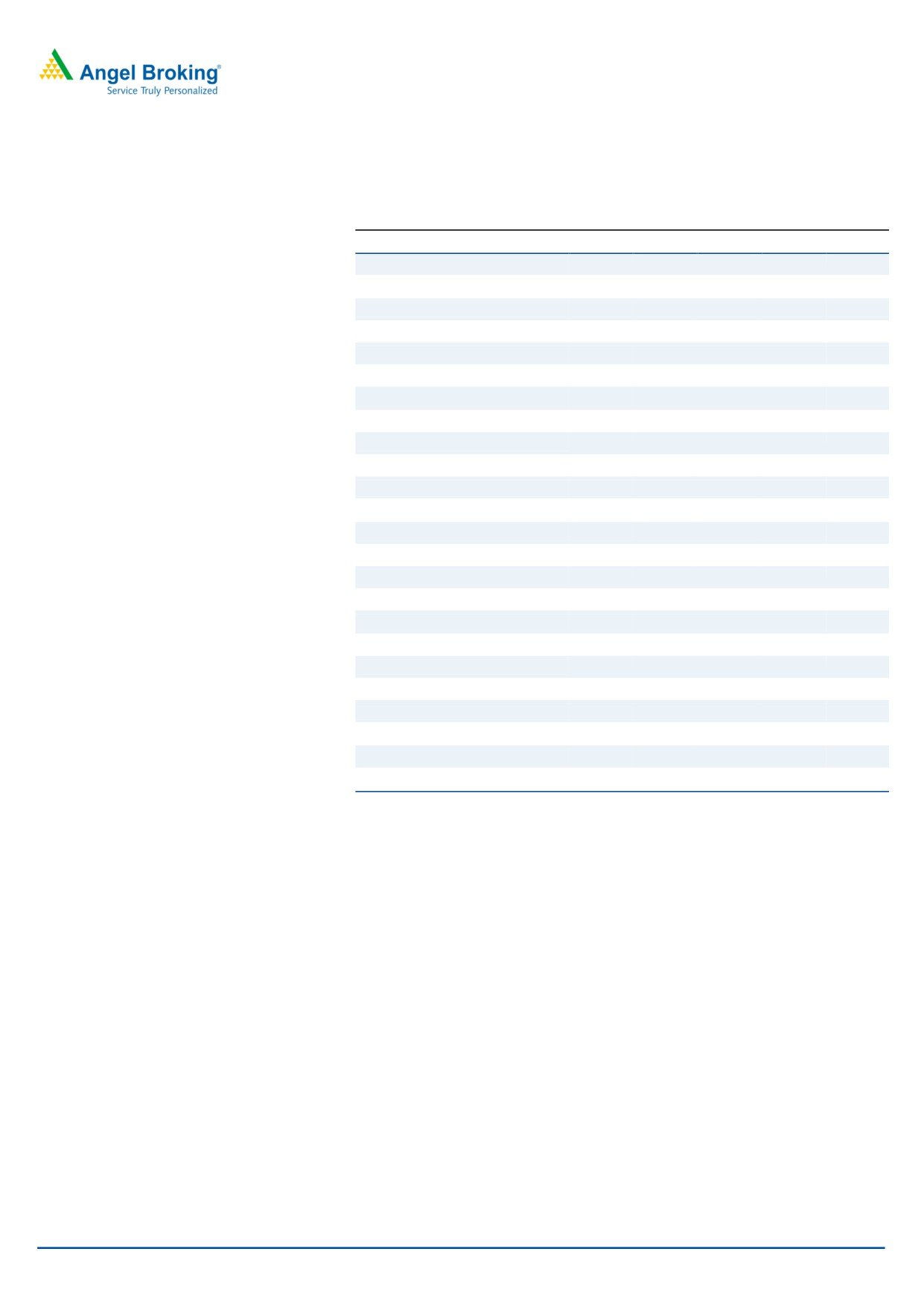

Key Financials

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Net Sales

292.1

353.0

405.7

480.8

577.6

% chg

- 5.1

20.9

14.9

18.5

20.1

Net Profit

19.9

33.3

42.7

51.7

62.0

% chg

6.4

67.0

28.3

21.1

20.0

EBITDA (%)

12.0

13.5

15.3

15.8

15.8

EPS (Rs)*

13.6

22.8

29.2

35.4

42.5

Nidhi Agrawal

P/E (x)

63.4

38.0

29.6

24.4

20.4

022-39357800 Ext: 6872

P/BV (x)

7.6

6.5

5.5

4.6

3.9

RoE (%)

11.9

17.1

18.5

18.8

19.0

RoCE (%)

16.1

20.3

22.7

23.7

24.0

EV/EBITDA

34.2

24.9

18.8

15.1

12.3

EV/Sales

4.1

3.4

2.9

2.4

1.9

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

GMM Pfaudler |4QFY2018 Result Update

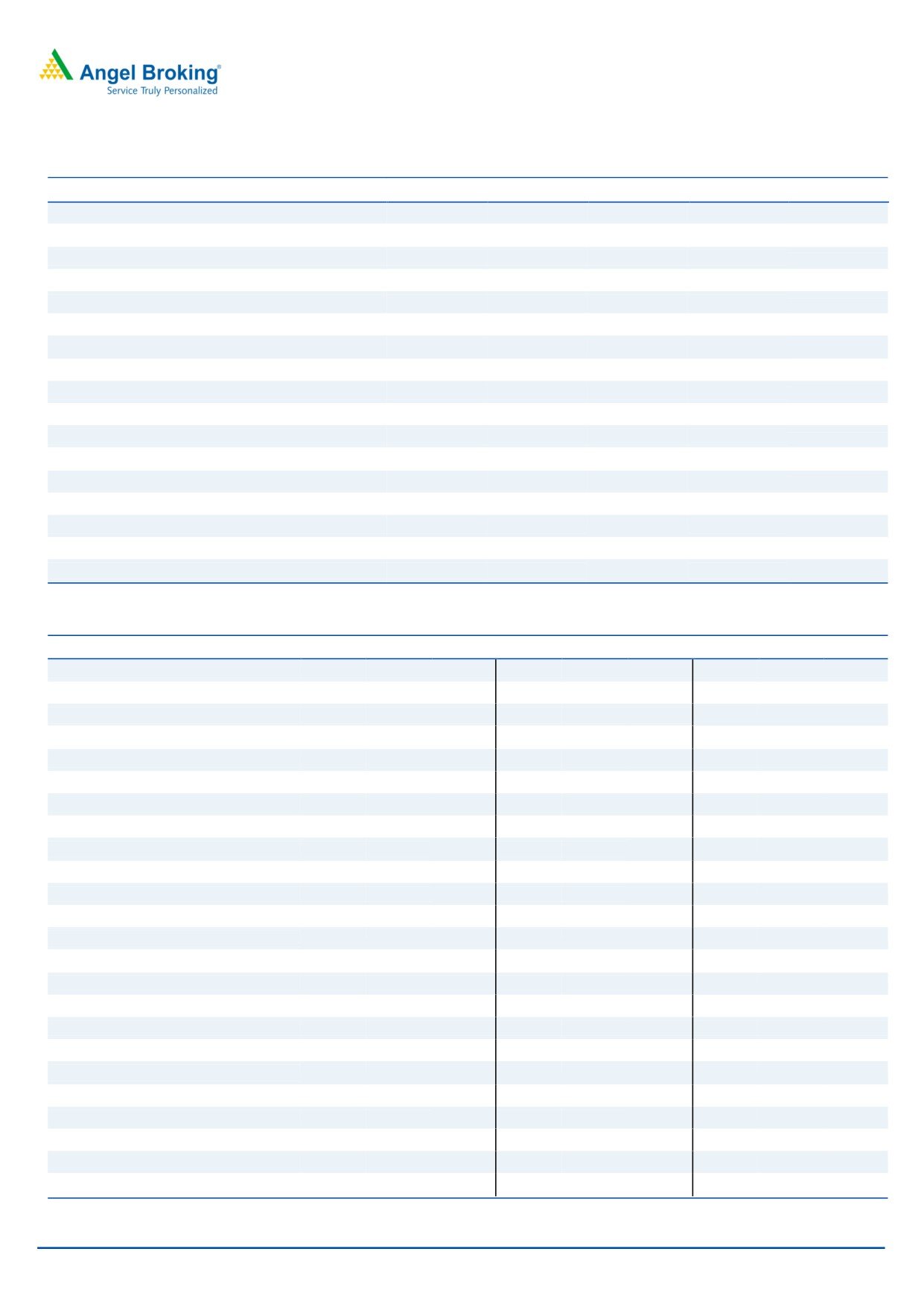

Exhibit 1: Q4 results at a glance

Standalone results -` cr

Q 4FY18

Q 4FY17

YoY %

Q 3FY18

QoQ %

Net Sales

88

79

10.9%

79

10.9%

Raw Material Consumed

41

37

10.7%

38

7.2%

Stock Adjustment

-3

-1

332.2%

-6

-44.1%

Employee Expe nse s

10

9

6.6%

9

9.9%

Other Expenses

27

24

11.0%

26

1.3%

Total Expenditure

73

69

6.6%

67

9.8%

EBITDA

14

11

36.6%

12

16.9%

Other Income

2

1

76.6%

1

140.2%

Interest

0

0

-27.9%

0

13.3%

Depreciation

2

2

17.3%

2

7.7%

PBT

14

9

47.5%

11

28.3%

Tax

6

2

167.2%

4

57.4%

Profit After Tax

8

7

14.1%

7

14.4%

R atios

EBITDA margin

16.4%

13.3%

15.5%

PATmargin %

9.6%

9.3%

9.3%

Tax rate %

39.7%

21.9%

32.4%

Source: Company

Exhibit 2: Segmental performance

Standalone

C onsolidated

Subsidiaries

FY18

FY17

YO Y

FY18

FY17

YO Y

FY18

FY17

YO Y

Glass Lined Equipments

219

195

12%

219

195

12%

Heavy Engineering

37

47

-21%

37

47

-21%

Proprietary Products

62

49

26%

155

136

14%

93

87

7.6%

Non GL segment

99

96

3%

192

183

5%

93

87

7.6%

Total Segme nt Revenue

318

291

9%

411

378

9%

93

87

7.6%

A s a % of revenue

Glass Lined Equipments

69%

67%

53%

52%

Heavy Engineering

12%

16%

9%

12%

Proprietary Products

20%

17%

38%

36%

Non GL segment

31%

33%

47%

48%

Profit/Loss Before Interest and Tax

52

45

14%

68

52

31%

16

6

160%

Glass Lined Equipments

43

36

20%

43

36

20%

Heavy Engineering

4

7

-40%

4

7

-40%

Proprietary Products

5

3

49%

21

9

126%

16

6

167%

Non-GL segment

9

10

-12%

25

16

55%

16

6

167%

PBIT margin %

16.3%

15.6%

16.4%

13.6%

17.1%

7.1%

Glass-Lined segment

19.6%

18.3%

19.6%

18.3%

Heavy Engineering

10.9%

14.4%

10.9%

14.4%

Proprietary Products

7.5%

6.4%

13.2%

6.7%

17.1%

6.9%

Non-GL segment

8.8%

10.3%

12.8%

8.7%

17.1%

6.9%

Source: Company

May 18, 2018

2

GMM Pfaudler |4QFY2018 Result Update

Outlook and Valuation

We have fine tuned our earnings estimates in view of FY2018 results. We are

expecting a CAGR of ~18%/20% in revenue/ earnings over FY18-20E. The stock

has given 21% return since our initiation in April and is currently trading at 20x its

FY2020 earnings which largely trails the earnings growth trajectory. Hence, we

recommend Accumulate with a target price of `920 (22x FY2020E EPS).

Risks to our estimates

GMM’s primary raw material is steel; any abrupt fluctuation in pricing will

adversely impact its profitability.

Business may get impacted owing to the inability to get break through with

new clients or slowdown in capex by its clients.

GMM has market exposure to foreign exchange rates mainly on account

of exports, imports and investments in foreign subsidiary, and therefore, it

is subjected to the exchange fluctuation risk.

May 18, 2018

3

GMM Pfaudler |4QFY2018 Result Update

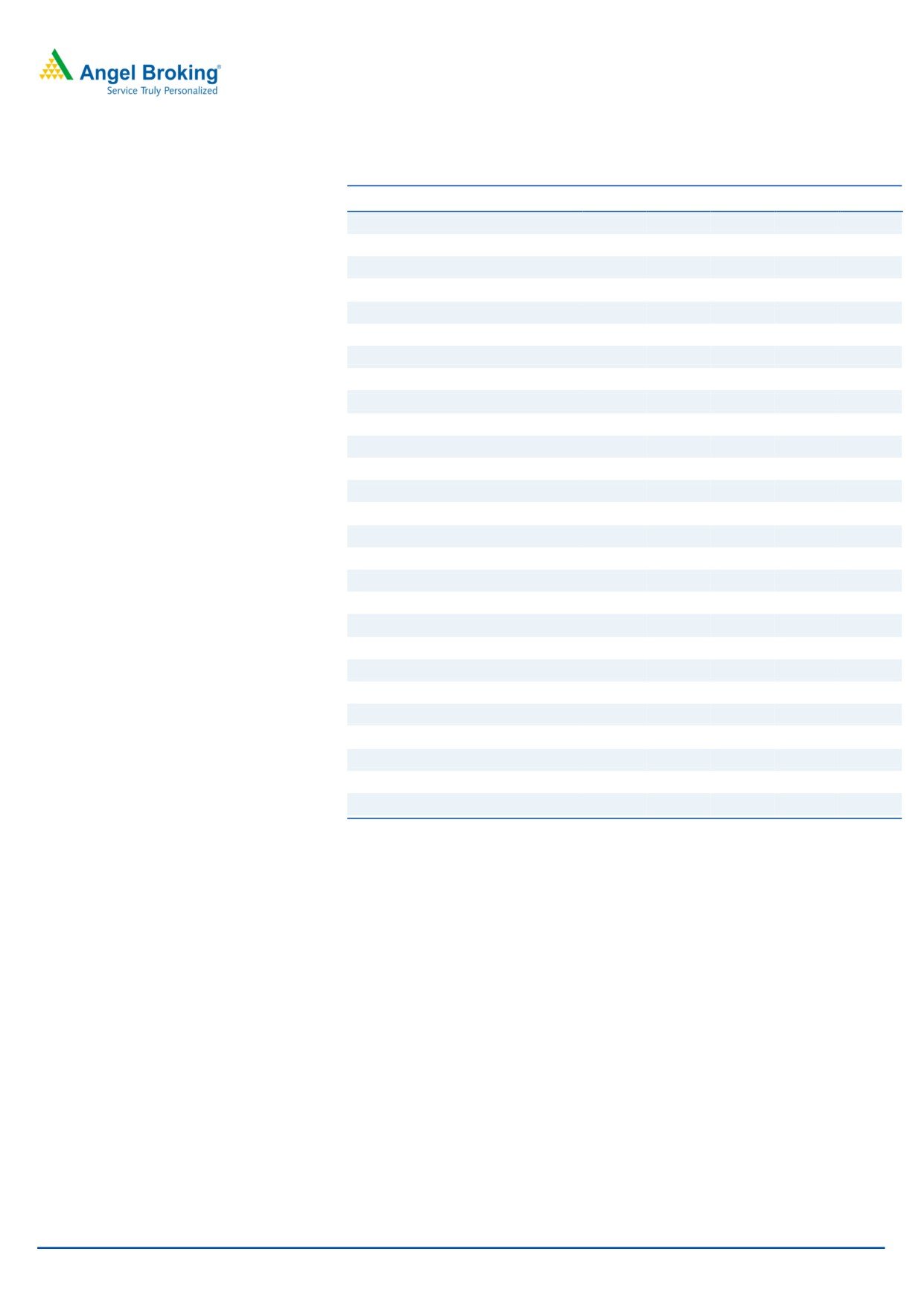

Profit & Loss Statement

Y/E March (`cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

292.1

353.0

405.7

480.8

577.6

% chg

- 5.1

20.9

14.9

18.5

20.1

Total Expenditure

257.1

305.3

336.7

404.9

486.4

COGS

173.4

209.6

240.9

285.5

343.0

Selling and Administration Expenses

19.2

22.1

23.7

28.1

33.7

Personnel

56.2

66.1

63.5

81.7

98.2

Others Expenses

8.4

7.6

8.7

9.6

11.6

EBITDA

34.9

47.7

69.0

75.9

91.2

% chg

- 2.8

36.6

44.5

10.1

20.1

(% of Net Sales)

12.0

13.5

17.0

15.8

15.8

Depreciation& Amortisation

8.1

8.2

9.8

10.8

12.7

EBIT

26.8

39.5

59.2

65.1

78.5

% chg

2.7

47.3

49.8

10.1

20.5

(% of Net Sales)

9.2

11.2

14.6

13.5

13.6

Interest & other Charges

0.7

0.9

1.0

1.0

1.0

Other Income

3.6

8.3

9.4

10.8

12.4

(% of Sales)

1.2

2.3

2.3

2.2

2.1

Extraordinary Items

-

-

-

-

-

Share in profit of Associ ates

-

-

-

-

-

Recurring PBT

29.8

46.9

67.5

74.9

89.9

% chg

5.6

57.4

44.1

10.9

20.0

Tax

9.7

13.6

18.0

23.2

27.9

PAT (reported)

19.9

33.3

42.7

51.7

62.0

% chg

6.4

67.0

28.3

21.1

20.0

(% of Net Sales)

6.8

9.4

10.5

10.8

10.7

Basic & Fully Diluted EPS (Rs)

13.6

22.8

29.2

35.4

42.5

% chg

6.4

67.0

28.3

21.1

20.0

May 18, 2018

4

GMM Pfaudler |4QFY2018 Result Update

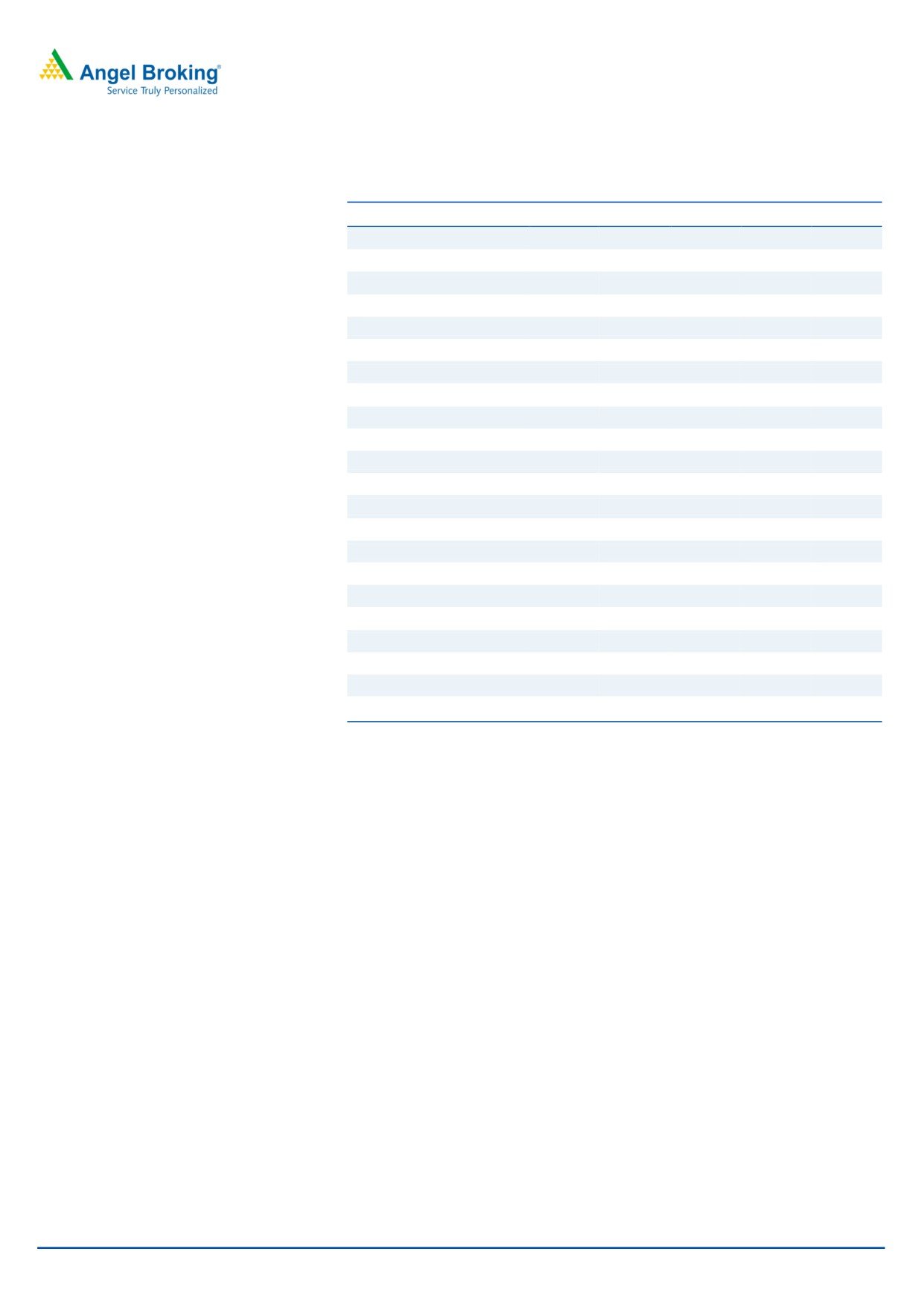

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

2.9

2.9

2.9

2.9

2.9

Reserves& Surplus

163.9

191.9

227.9

271.5

323.8

Shareholders Funds

166.8

194.8

230.8

274.4

326.8

Minority Interest

-

-

-

-

-

Total Loans

-

-

-

-

-

Other Liab & Prov

4.4

11.1

11.6

12.1

12.8

Total Liabilities

171.3

205.9

242.4

286.6

339.6

APPLICATION OF FUNDS

Net Block

53.4

61.2

66.4

70.6

72.9

Capital Work-in-Progress

4.3

2.0

2.0

2.0

2.0

Investments

13.7

44.6

64.6

84.6

94.6

Curre nt Assets

178.6

207.9

233.2

269.4

338.3

Inventories

70.9

82.3

94.5

112.0

134.6

Sundry De btors

48.7

69.9

80.3

95.2

114.4

Cash

53.6

31.7

30.6

29.3

49.9

Loans & Advances

5.5

24.1

27.7

32.8

39.4

Other Assets

-

-

-

-

-

Current liabilities

84.4

113.2

127.9

144.9

174.1

Net Current Assets

94.2

94.7

105.3

124.5

164.2

Other Non Current Asset

5.6

3.4

4.1

4.8

5.8

Total Assets

171.3

205.9

242.4

286.6

339.6

May 18, 2018

5

GMM Pfaudler |4QFY2018 Result Update

Consolidated Cashflow Statement

Y/E March (`cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

29.8

46.9

60.7

74.9

89.9

Depreciation

8.1

8.2

9.8

10.8

12.7

Change in Working Capital

(2.0)

(12.8)

(9.7)

(20.5)

(19.2)

Interest / Dividend (Net)

-

-

-

-

-

Direct taxes paid

(9.6)

(14.0)

(18.0)

(23.2)

(27.9)

Others

1.8

5.3

-

-

-

C ash Flow from Operati ons

24.7

23.0

42.8

42.0

55.6

(Inc.)/ Dec. i n Fixed Assets

(13.9)

(14.4)

(15.0)

(15.0)

(15.0)

(Inc.)/ Dec. i n Inve stments

0.3

0.1

-

-

-

C ash Flow from Inve sting

(17.0)

(22.0)

(36.9)

(35.4)

(25.5)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

Others

6.0

6.3

6.7

8.1

9.7

C ash Flow from Financing

(6.0)

(6.3)

(6.7)

(8.1)

(9.7)

Inc./(Dec.) in Cash

1.7

(5.3)

(0.8)

(1.5)

20.4

O pening Cash balance s

34.7

36.4

31.1

30.3

28.8

Closing Cash balances

36.4

31.1

30.3

28.8

49.2

May 18, 2018

6

GMM Pfaudler |4QFY2018 Result Update

Key Ratios

Y/E March

FY16

FY17

FY18E

FY19E

FY20E

Valuati on Ratio (x)

P/E (on FDEPS)

63.4

38.0

29.6

24.4

20.4

P/CEPS

33.9

22.2

17.5

14.6

12.2

P/BV

7.6

6.5

5.5

4.6

3.9

Dividend yield (%)

0.3

0.5

0.5

0.5

0.6

EV/Sales

4.1

3.4

2.9

2.4

1.9

EV/EBITDA

34.2

24.9

18.8

15.1

12.3

EV / Total Assets

7.0

5.8

4.8

4.0

3.3

Per Share Data (Rs)

EPS (Basic)

13.6

22.8

29.2

35.4

42.5

EPS (fully diluted)

13.6

22.8

29.2

35.4

42.5

Cash EPS

25.5

38.9

49.4

59.1

70.7

DPS

3.0

4.0

4.0

4.6

5.5

Book Value

114.3

133.4

158.1

188.0

223.8

Returns (%)

ROCE

16.1

20.3

22.7

23.7

24.0

Angel ROIC (Pre-tax)

25.8

30.5

35.5

37.7

40.3

ROE

11.9

17.1

18.5

18.8

19.0

Turnover rati os (x)

Asset Turnover (Gross Block)

2.6

3.1

3.2

3.4

3.7

Inventory / Sales (days)

89

85

85

85

85

Receivables (days)

61

72

72

72

72

Payable s (days)

101

115

115

110

110

WC cycle (ex-cash) (days)

48

42

42

47

47

Source: Company, Angel Research

May 18, 2018

7

GMM Pfaudler |4QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positio ns and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that ma y arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please r efer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

GMM Pfaudler

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 18, 2018

8